Business W 9

That is a partner in a partnership conducting a trade or business in the united states provide form w 9 to the partnership to establish your u s.

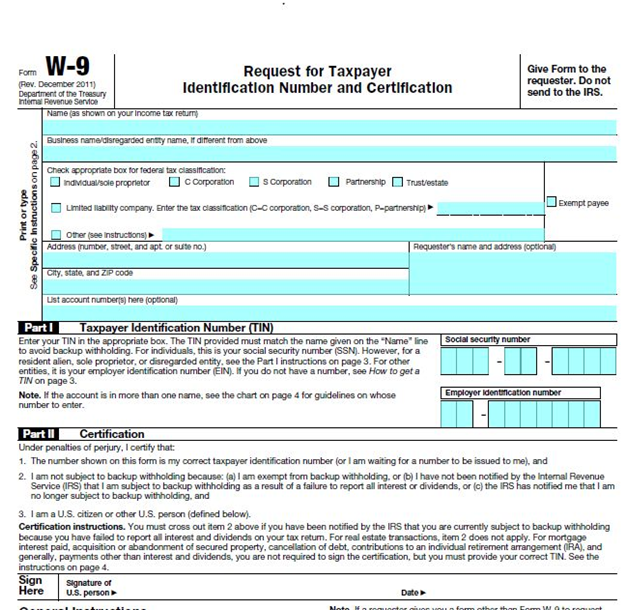

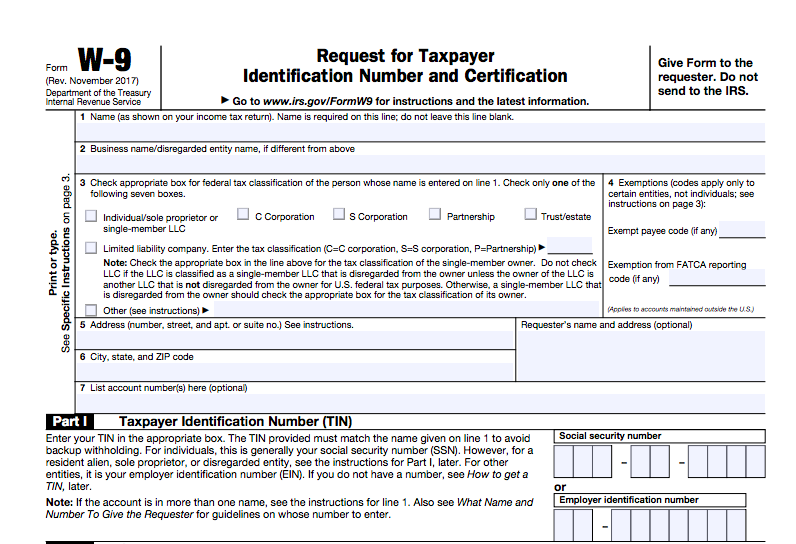

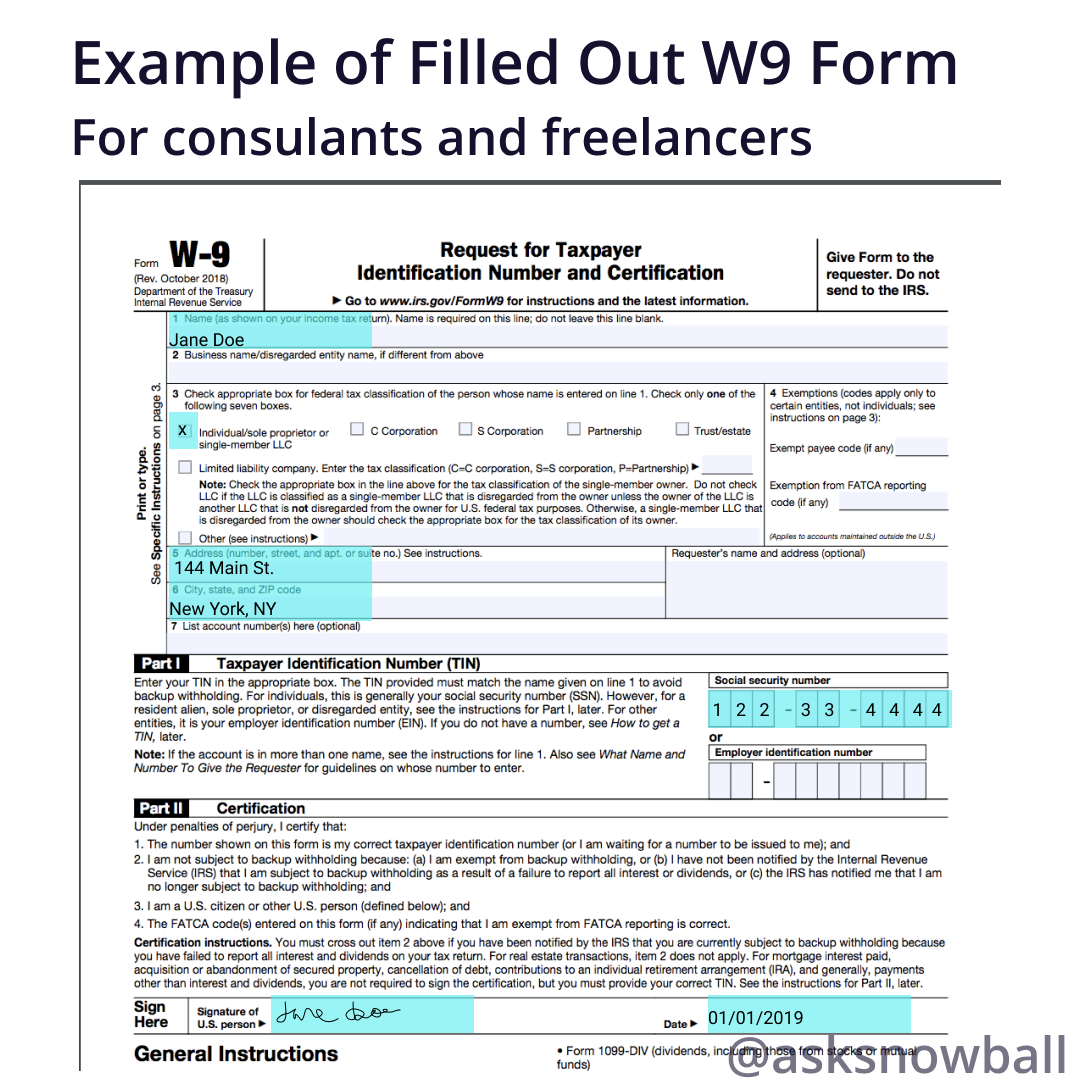

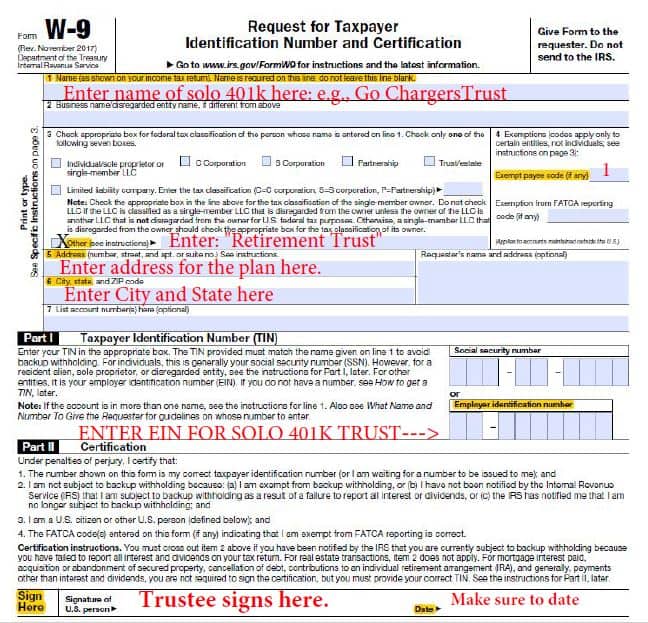

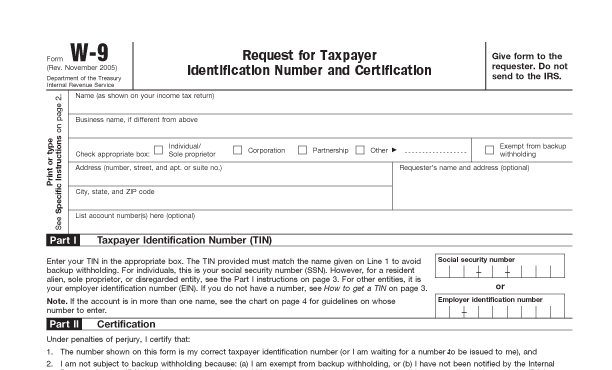

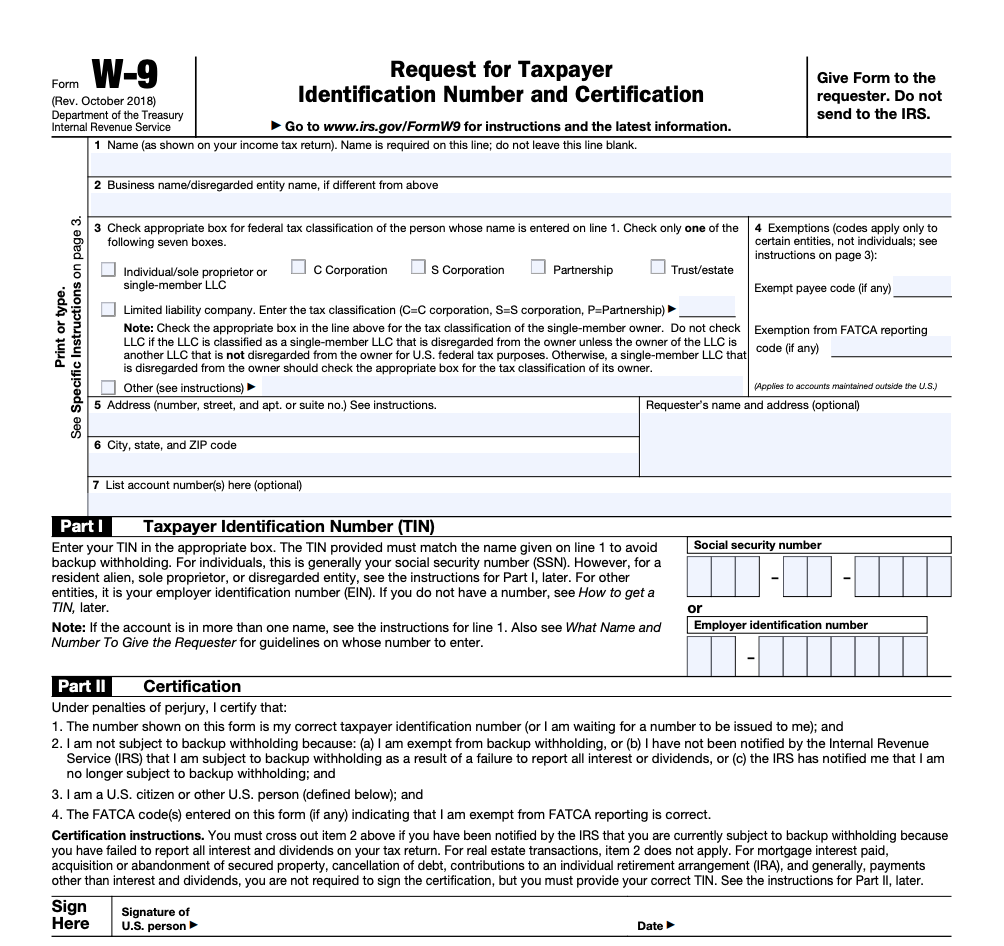

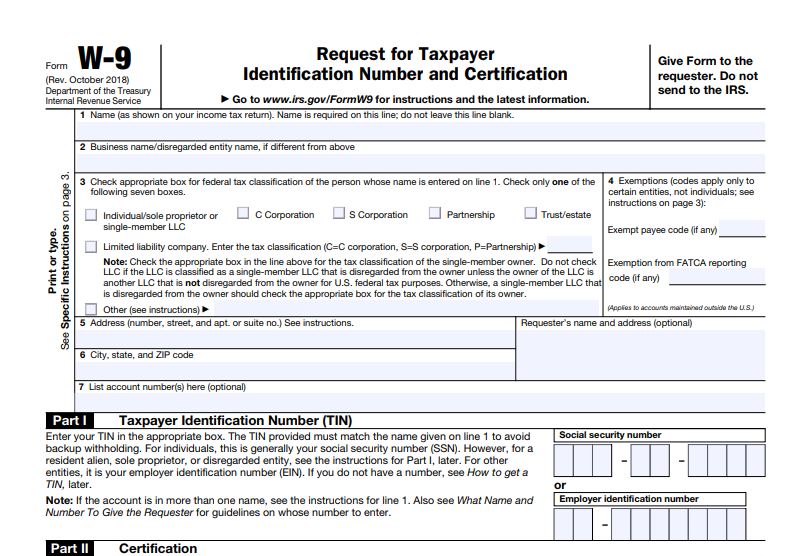

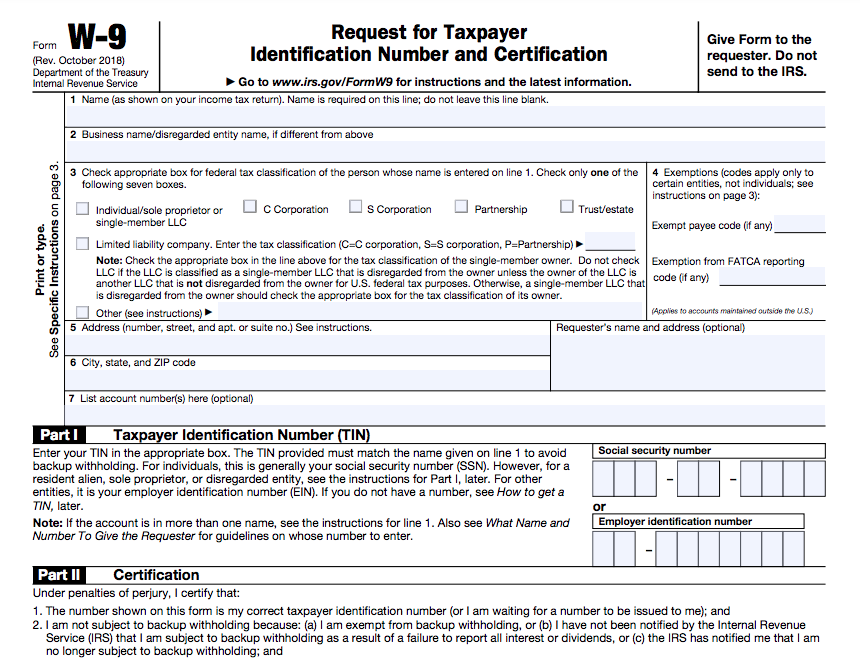

Business w 9. Form w 9 is an irs form that is filled out by self employed workers for companies they are providing services for. Status and avoid section 1446 withholding on your share of partnership income. Enter your business name if different on the second line. Enter your name as shown on your income tax return on the first line.

Form w 9 asks for the independent contractor s name business name if different business entity sole proprietorship partnership c corporation s corporation trust estate limited liability. Form w 9 is officially titled request for taxpayer identification number and certification. The tin you gave is correct. What is a w 9.

Vendor s business name or personal name if a sole proprietor. By signing it you attest that. Obtain a w 9 form from the irs gov website. The taxpayer you the payee isn t subject to backup withholding.

Payees must provide their full name or the name of their business if not a sole. Type your information directly into the form and save a copy of it to your hard drive or download and print out the form and then complete it by hand. This can be a social security number or the employer identification number ein for a business. A 1099 is kind of like a w 2 but for businesses and contractors.

Companies use w 9 s to file form 1099 nec or form 1099 misc both of which notify the irs how much they ve paid to non employees during a tax year. Use form w 9 to provide your correct taxpayer identification number tin to the person who is required to file an information return with the irs to report for example. Businesses do not withhold taxes for other businesses so your clients will use the information on form w 9 to fill out a 1099. Form w 9 is sent to the company that requested it not to the irs.

Income paid to you. Business employer identification number ein or social security number. Acquisition or abandonment of secured property. Mortgage interest you paid.

In the cases below the following person must give form w 9 to the. W 9 tells another business that you are legal to operate in the united states and which social security number or business tax id to use for tax reporting.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)