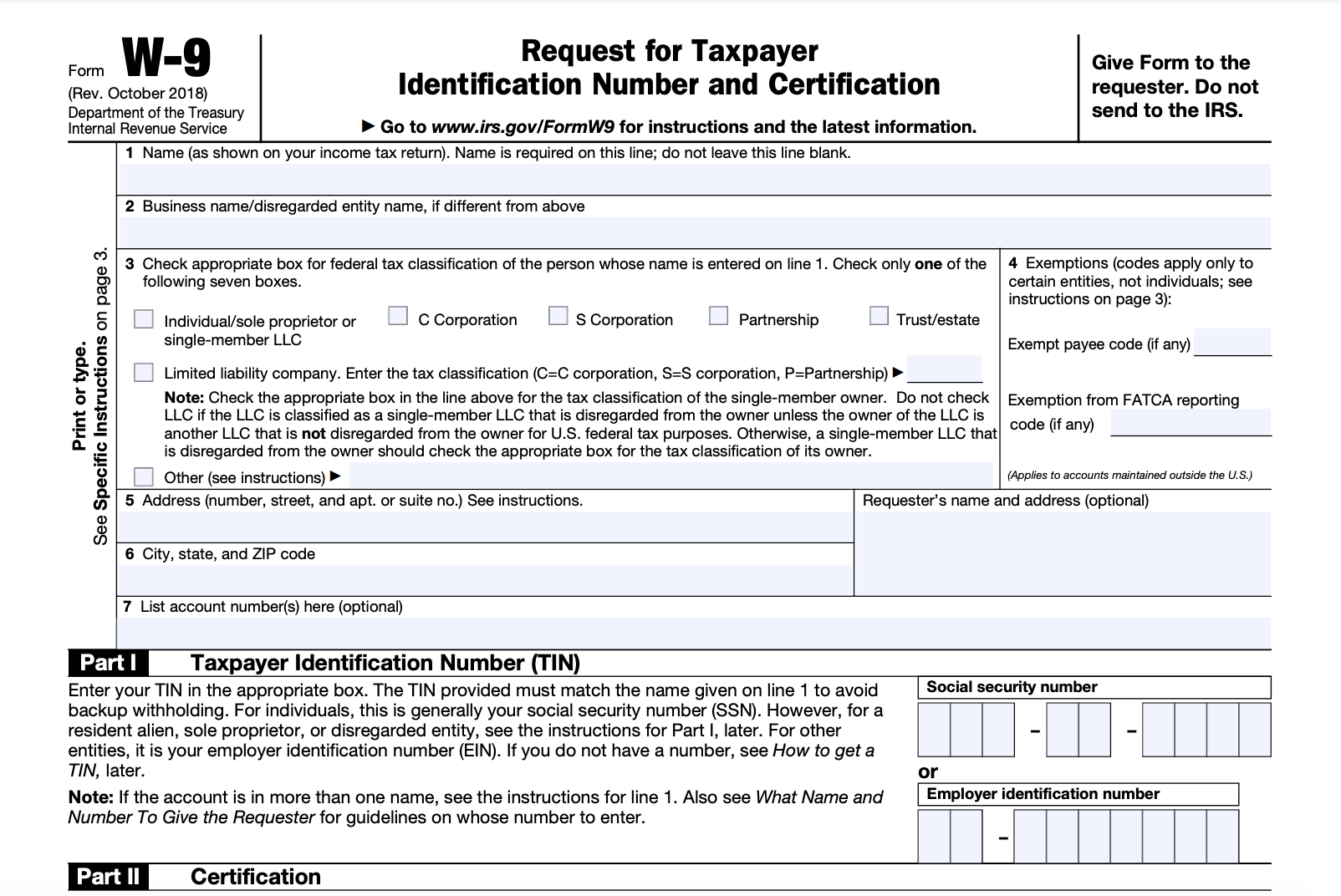

Business W 9 Form 2020

Generally only a nonresident alien individual may use the terms of a tax treaty to reduce.

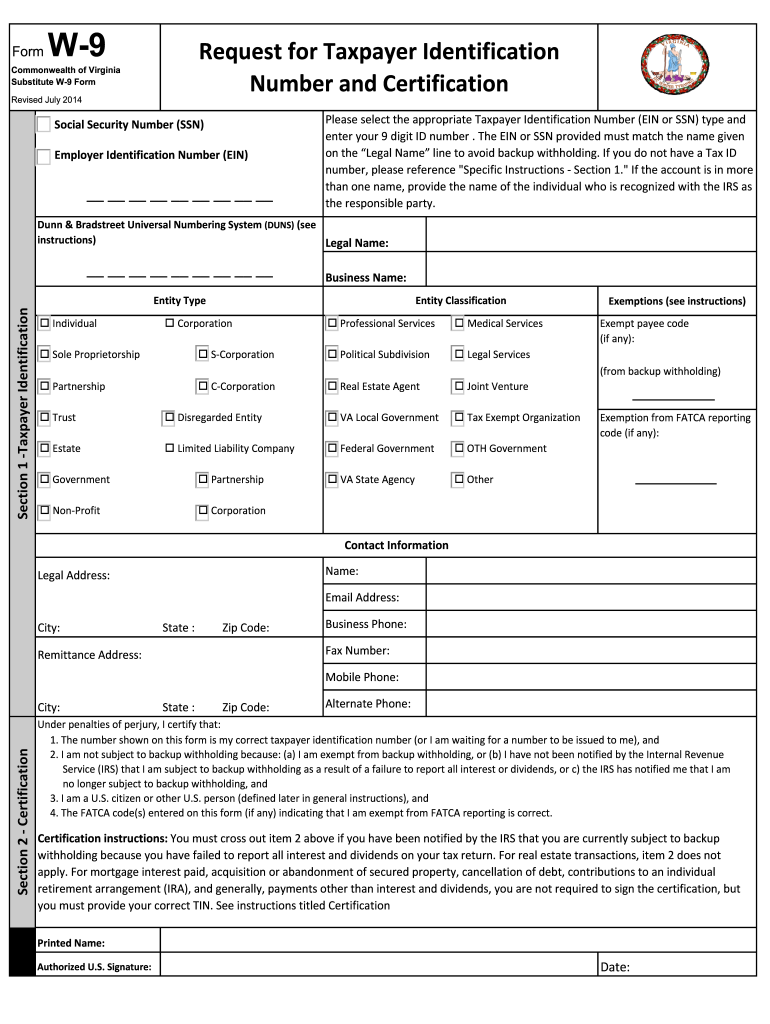

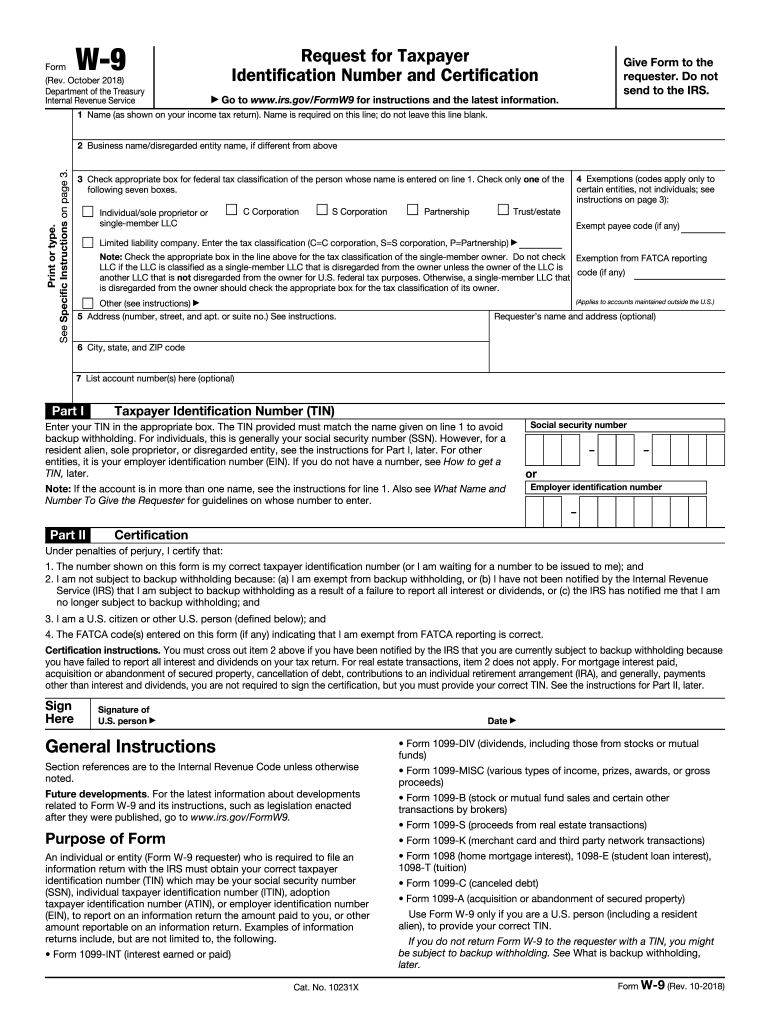

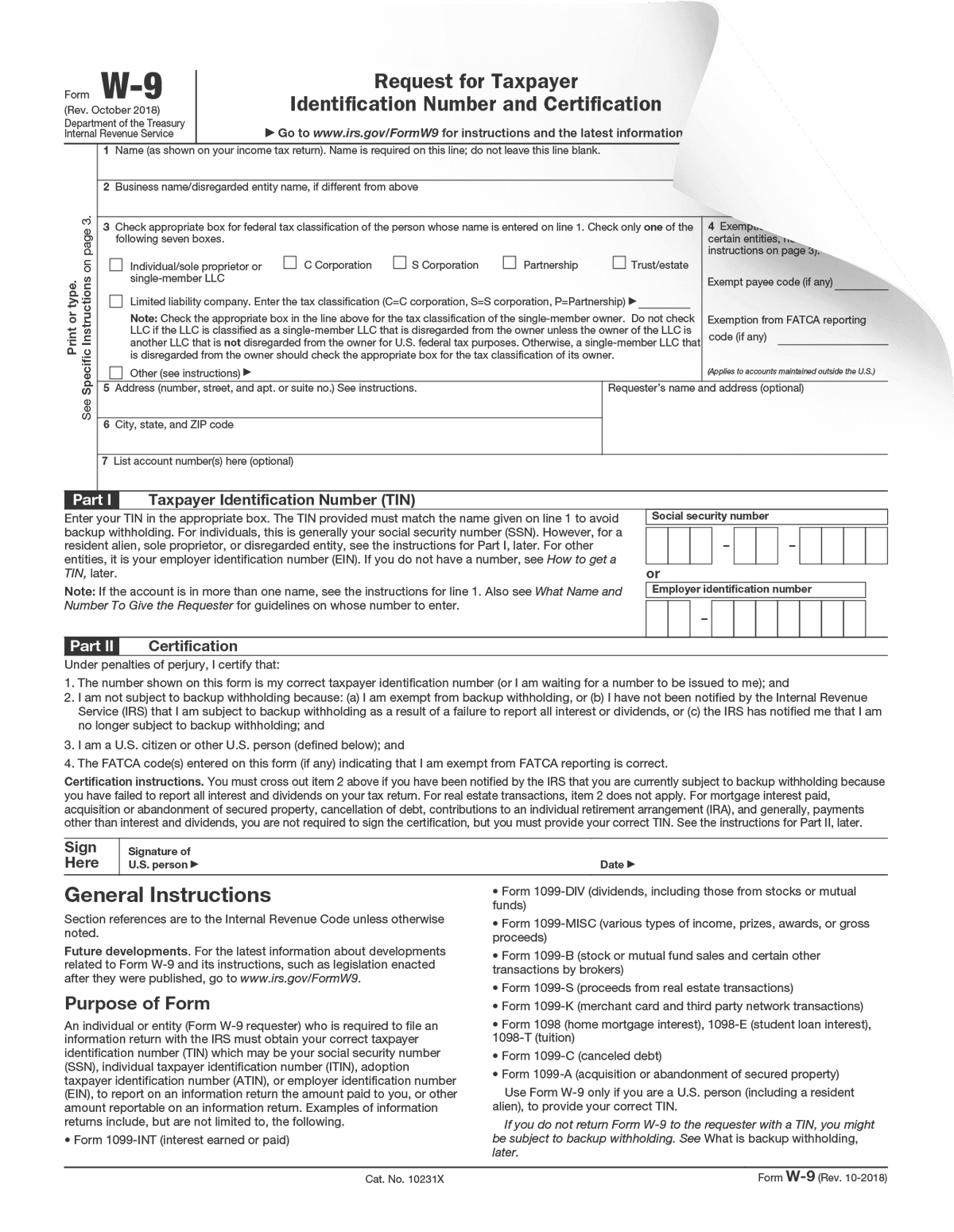

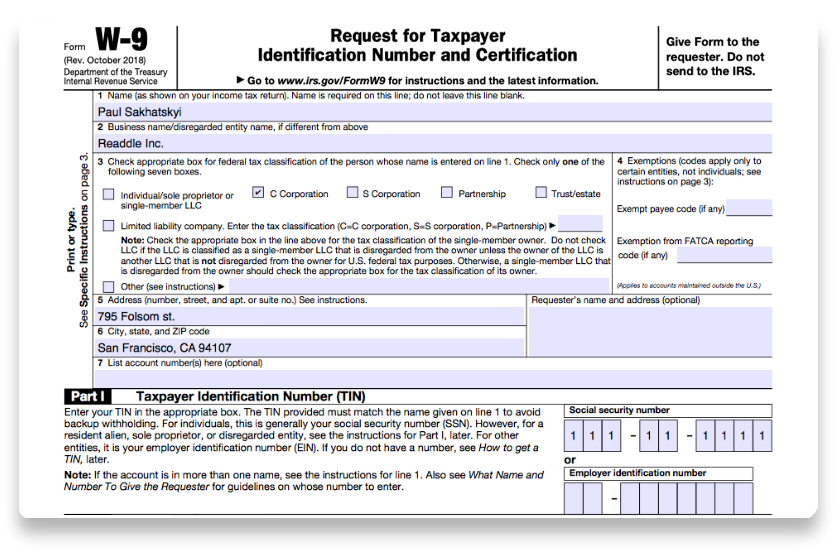

Business w 9 form 2020. The w 9 should be kept in your files for four years for future reference in case of any questions from the worker or the irs. Not filing w 9 form in 2020. Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10 29 2018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente. March 7 2019 the irs form w 9 tax form is vital for small business owners.

Not filing a w 9 form that is requested by an employer or by any other entity will bring you penalties. Employers need this data to report on their annual tax returns. It is currently 50 for each instance you don t file. Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs.

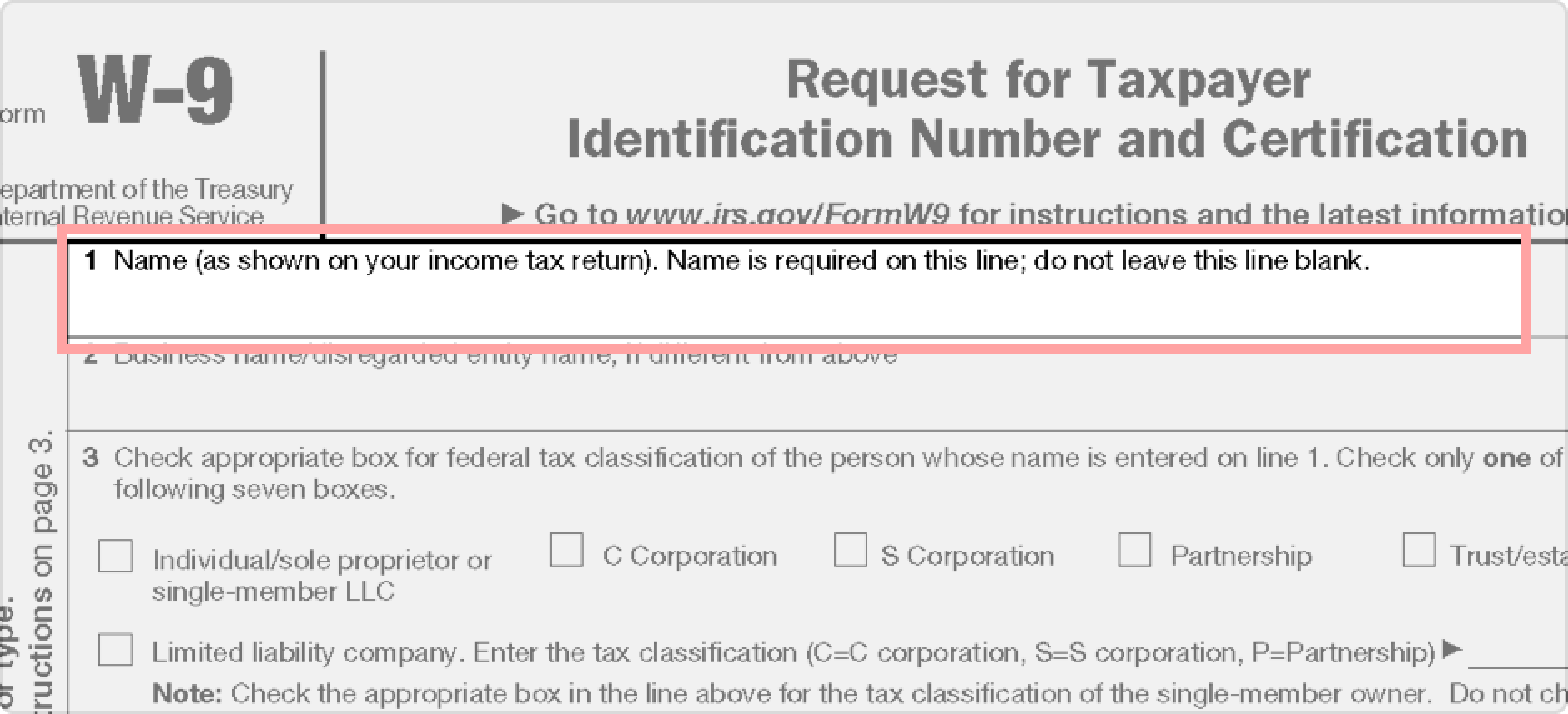

What is a w 9 tax form. What is w 9 form 2020 printable and how to fill it you can download print and fill out it create your own w 9 tax form online w 9 is an irs government form that is used by business entities to request essential information from independent contractors they work with. Request for taxpayer identification number tin and certification. This can only be done via w 9.

Irs covidreliefirs irsnews august 7 2020. So if you re working as a contractor or as a freelancer you must file a w 9 form upon request of a business you ve worked for. You may develop and use your own form w 9 a substitute form w 9 if its content is substantially similar to the official irs form w 9 and it satisfies certain certification requirements. Employer s quarterly federal tax return.

Participating foreign financial institution to report all united states 515 withholding of tax on nonresident aliens and foreign entities. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file. Request for taxpayer identification number and certification 1018 10 24 2018 inst w 9. When collaborating with independent contractors in the us the businesses use the w 9 form to request freelancer s information.

Updated w 9 form 2020. Employers engaged in a trade or business who pay compensation. You ll need this whenever you hire an independent contractor for your business. Popular for tax pros.

Let s go over what this means for you. You may incorporate a substitute form w 9 into other business forms you customarily use such as account signature cards. Beginning with tax year 2020 you must use form 1099 nec nonemployee compensation to report payments of nonemployee compensation nec previously reported in box 7 on form 1099 misc. The w 9 form requires the contractor to list his or her name address.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

:max_bytes(150000):strip_icc()/irsformw-9-4f99b4002b434b53a6535c25092b3318.jpg)